Despite the widely forecast drop in trailer production next year, the industry needs to keep the downturn in perspective, suggests Don Ake, vice-president, commercial vehicles, for FTR. He sums up the market quite succinctly: “Not too shabby.”

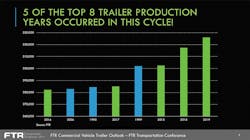

“This is the longest economic recovery in history. But because we don’t live in history, we don’t realize the impact of that. But more than 10 years of economic growth is just super,” Ake said. “You thought that the truck market was great? The last few years, the trailer market was even better.”

He noted that five of the top eight trailer production years occurred in this cycle, and three of them are the highest ever—”a tremendous run for the trailer market.”

Ake specified five factors that fueled the growth in trailer production:

• Dry van pent-up demand from the Great Recession

• Significant increase in drop-and-hook operations in dry and refrigerated vans due to driver shortage and customer service requirements

• Consumer preference for more variety of foods and faster delivery (boosts demand for refrigerated vans)

• Large increase in temperature-controlled freight (more refrigerated vans needed); and

• Big increase in the use of older dry vans for temporary goods storage.

He also pointed to Amazon’s development of its own fleet, and an order of 25,000 trailers. He calls the shifts associated with e-commerce trends “the changing freight structure.”

“You’ve got to be closer to the customer, you’ve got to respond to the changing needs faster. That means you have all these regional warehouses coming up, and you have movement between those warehouses,” Ake said. “It creates your shorter length of haul, and your carriers start making more deliveries per week. But in making those deliveries, you have more wait time and fewer miles, which the drivers don’t like—then you throw in the hours of service and the ELD.”

In short, there’s more emphasis than ever on keeping goods moving, and “you need more trailers to make this freight system work,” he suggested.

That’s the good news, but Ake does have concerns. Among these are what he calls “the Great Divide,” or the difference between van production and specialty or vocational trailers. Essentially, from the 1990s, production had followed the same trendlines. Then, beginning in 2015, those five factors kicked in and van production far outpaced vocational trailer production (with the exception of the 2018 surge during which the trendlines merged before separating again early this year).

“The forecast says that we expect the economic downturn to affect vans a little bit more than it did last time,” Ake said. “But if the economics impact the van segments more this time, and those effects start to fade [and the gap closes], then the forecast goes down 10,000 to 20,000 units.

“But if you’re an optimist, and expect those online things to continue, then even though the FTR forecast is a little optimistic, there’s still an upside. I don’t see the impact going away. It may be modified a little bit, but it shouldn’t go away.”

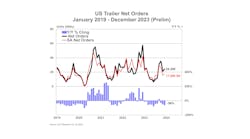

Ake also noted that those factors in van growth that began in 2015 have led to three consecutive forecasts that underestimated trailer production.

“I really hope I under-forecast four years [in a row],” he said. “So [based on the previous forecasts] you could bet this forecast is low—but I wouldn’t bet a lot on it.”

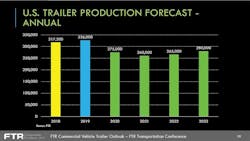

The forecast

Indeed, in presenting the FTR trailer numbers, Ake emphasized that his is “a very positive forecast.”

Annual production will finish 2019 at 326,000 trailers, up from 317,200 last year. FTR forecasts production to be 275,000 trailers in 2020; 260,000 in 2021; 265,000 in 2022; and to rebound to 280,000 in 2023.

Quarterly through 2020, FTR reports the second quarter this year set the record, with 88,319 trailers built. The Q3 estimate is a still-strong 81,320 before declining to 71,900 in Q4. For next year, Q1 slips slightly to 71,100 trailers built; Q2 is forecast to be 73,200; Q3 to be 67,300; and Q4 will fall to 63,400.

By segment, the 2020 FTR forecast has dry van down 15.9%; reefer down 15.1%; flatbed down 14.9%; dump down 9.6%; liquid tank down 17.7%; dry tank down 8.9%; and low beds down 22.2%.

In support of the forecast, Ake noted that the trailer build trend for 2018-2020 lines up very nicely with the 2014-2016 cycle.

“As long as the economy stays up, we’re looking for the van market—back to that Great Divide—to stay up, and as long as it stays up, we don’t look at trailer production dropping too far,” Ake said. “If we get some weakness in the economy, then forget about the 260 and 265 [in 2021 and 2022]. It’ll go much lower.”

Flatbed market

In looking at the flatbed market, the trends have been much more uneven since 2015, with falls and rises closely tied to economic sectors—but with flatbed fleet purchases running slightly behind the curve.

“So you’re putting tons of flatbeds into the market, but at some point supply catches up with demand,” Ake said.

And that point was the second half of this year.

“It’s happening. For the flatbed market in the fourth quarter, the backlogs are very low. The build in the fourth quarter will be weak,” Ake said. “What the OEMs are hoping, and what we’ve built into our forecast, is that we’ve caught up in 2019. And we’re hoping that things improve a little bit in 2020 and stabilizes this market.”

But, Ake continued, though the flatbed production curve is due for a rebound, the freight is not there.

“We hope we get to replacement demand; we hope for stabilization. But this is concerning,” he said. “It’s also concerning that the Class 8 market followed the flatbed market last time. We don’t think that’s going to happen, but there is the potential.”

Class 8

The FTR Class 8 forecast hinges on several of the economic factors discussed throughout this year’s conference, with downside risks coming from economic uncertainty, a further slowing of manufacturing activity; and record high truck inventories. On the upside, resolution of trade issues should be a significant positive for freight.

Quarterly through 2020, FTR has Class 8 North American shipments falling from the high of 96,000 trucks in the second quarter this year to 92,000 in Q3 and 75,000 in Q4. For 2020, the slide continues with 69,000 shipments in Q1; 71,000 in Q2; 62,000 in Q3; and 58,000 in Q4.

The long-term outlook puts final Class 8 production for 2019 at 353,000 units (up from 323,000 last year). For 2020, FTR forecasts 260,000 Class 8 shipments; 245,000 in 2021; 250,000 in 2022; and 275,000 in 2023.

“If you just looked at this in a vacuum, you’d think things are horrible. But I think the market’s trying to get back to normal,” Ake said. “It’s trying to balance out. We were overly high now we’re abnormally low. But if you averaged it out, it came out very good.”

Ake also put a positive spin on Class 8 cancellations.

“I thought that once we got into the middle of this year, that we would see cancellations spike. We saw cancellations increase, but not spike,” he said. “Fleets are taking most of these trucks, which is a very good sign for the market. Again, it’s a normalization of the market, not a crash of the market.”

For those looking to next year, Ake suggested keeping an eye on the Fall order season.

“October is a key month for the orders. It’s a key month for looking at 2020,” he said. “Because if the orders don’t pop up in October, if that line keeps going down, then there’s a problem.”